Table of Contents >> Show >> Hide

- What “home equity” really is (and why it feels like found money)

- Why equity has been piling up lately

- How much equity are we talking about?

- Equity wealth: what it changes for homeowners

- How homeowners tap equity (without turning the house into an ATM)

- A quick example: how equity builds faster than you think

- The reality check: equity is real wealth, but it has real risk

- What 2026 might mean for homeowner equity

- How to use equity wisely: a practical “no regrets” checklist

- Homeowner experiences: how equity wealth feels in real life

If your home had a fitness tracker, it would be screaming, “I’m closing my rings!”because across the U.S.,

homeowner equity has been quietly (and sometimes not-so-quietly) bulking up. Even after the white-hot

pandemic-era surge cooled, home values have largely held up, and many owners are still paying down

mortgages that were locked in at rates that now feel like a museum exhibit.

The result: a growing pile of home equitythe difference between what your home could sell for and what you

still owe. That equity is a big slice of household wealth, and it’s shaping everything from remodeling plans

to retirement strategies to whether people feel comfortable switching jobs, moving cities, or finally buying

the fancy fridge that makes spherical ice “for the vibes.”

What “home equity” really is (and why it feels like found money)

Home equity is simple math with big feelings: Home value − mortgage balance = equity.

The emotional part is that equity often grows in the background, like a houseplant you forgot to water that

somehow thrives anyway.

Two engines power equity growth

-

Price appreciation: When home prices rise, your equity can jump even if you don’t pay a

dollar extra on the mortgage. -

Principal paydown: Every monthly payment chips away at what you owe (especially after the

early years of a mortgage), steadily raising your ownership stake.

Put those together and you get a “forced savings” machine. It’s not magicmaintenance, taxes, insurance, and

repairs are very realbut equity has become a major way U.S. households build net worth over time.

Why equity has been piling up lately

The short version: prices rose a lot, then rose a little more. The longer version includes a few important

plot twists.

1) Home prices climbed faster than many expected

National price growth moderated compared with the boom years, but “moderated” doesn’t mean “reversed.” Some

measures showed modest year-over-year gains in 2025, while others reflected a flatter, choppier patternstill

leaving many homeowners sitting on large unrealized gains compared with pre-2020 purchase prices.

2) The “rate lock-in” effect kept inventory tight

Millions of homeowners refinanced or bought when rates were far lower than today’s. That created a powerful

incentive to stay put: selling and taking a new mortgage at a higher rate can make the next home dramatically

more expensive, even if the sticker price is similar. Fewer listings can support prices, which supports equity.

3) Mortgage balances kept growingjust not as fast as values did (for many owners)

U.S. mortgage debt has continued to rise, but not everyone’s debt is rising at the same pace. Long-tenured

owners with fixed-rate loans are paying down balances; newer buyers may be earlier in amortization or carrying

higher purchase loans. That difference matters because equity outcomes are increasingly uneven by tenure.

How much equity are we talking about?

Big-picture: it’s a lot. One widely cited estimate put average borrower equity in the neighborhood of

$300,000+ in 2025, depending on the quarter and data source. That’s not “couch cushion money.”

That’s “my house could fund a midlife crisis and still have enough left for a roof.”

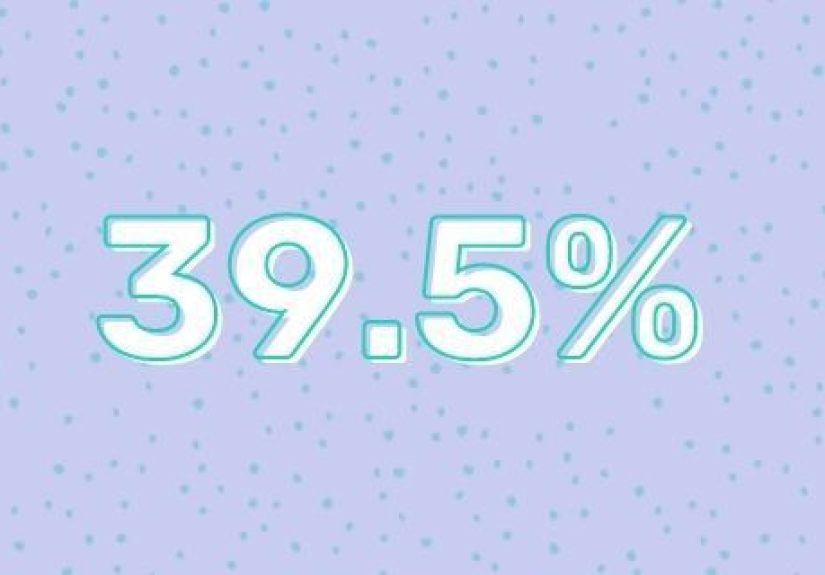

Equity-rich isn’t a niche category anymore

A striking share of mortgaged homes are now considered equity-richtypically defined as owing

no more than half the property’s estimated market value. In late 2025, roughly

about 46% of mortgaged residential properties fell into that category, a level that would have

sounded wild a decade ago.

But equity growth isn’t uniform

Some owners saw huge gains during the rapid run-up from 2020 to 2022, while others bought closer to recent peaks

and have experienced slower appreciation since. Regional outcomes differ, too. Even when national appreciation

looks modest, certain markets can run hotter (or cooler) based on local jobs, new construction, insurance costs,

migration patterns, and just how badly people want to live near that one taco place everyone posts about.

Equity wealth: what it changes for homeowners

Equity is not the same as cash, but it can change behavior because it affects security, options, and borrowing power.

Think of it as the financial equivalent of having an umbrella in your bag: you might not use it every day, but you

walk differently when you have it.

1) The “move-up” decision gets complicated

Homeowners with substantial equity may be better positioned to put a large down payment on a new home. But higher

mortgage rates can still make the monthly payment painful. So you get a weird mix: people who could afford to move

choose not to, and people who want to move can’t. That keeps supply constrained and props up equity for those who stay.

2) Renovations become a wealth strategy (not just a Pinterest board)

When owners feel equity-rich, they’re more likely to remodelkitchens, bathrooms, adding a home office, fixing the

deck that has “character” (and by character, we mean splinters). Some improvements can boost resale value; others

mostly boost joy. Either way, equity often becomes the funding source.

3) It can provide a financial safety net

For households facing job changes, medical bills, or major repairs, the ability to borrow against equity can prevent

worse outcomes like high-interest debt spirals. Used carefully, equity can be a stabilizerespecially when other

credit is expensive.

How homeowners tap equity (without turning the house into an ATM)

There are a few main ways people access equity. Each comes with trade-offs, and the best choice depends on your rate,

your timeline, and whether you enjoy stress (some people run marathons; some compare closing costs for fun).

Home equity loan

A home equity loan is typically a lump sum with a fixed rate and fixed payment. It can work well for a one-time

project with a clear budget, like replacing a roof or consolidating high-interest debtassuming the new payment is

manageable and the debt problem won’t come right back wearing a fake mustache.

HELOC (home equity line of credit)

A HELOC works more like a credit card secured by your home: you can draw funds up to a limit during a draw period,

often with a variable rate. It’s flexible for ongoing projects, but variable rates can change the monthly cost.

Translation: great tool, but it demands attention.

Cash-out refinance (less common when rates are higher)

Cash-out refis exploded when mortgage rates were low. When rates rise, cash-out refis often slow because homeowners

don’t want to replace a low-rate first mortgage with a higher-rate one. Some still do it when the need is urgent or

the math still works, but it’s a much higher bar.

“Tappable” equity has limits

Even if you have a ton of equity, lenders usually want you to keep a bufferoften meaning you can’t borrow all the

way up to 100% of your home value. In practice, many lenders cap total borrowing around 80% to 85% loan-to-value,

depending on credit and the product. So the equity you can access is typically less than the equity you have.

A quick example: how equity builds faster than you think

Let’s say you bought a home for $400,000 and put 10% down ($40,000), borrowing

$360,000. Five years later:

- If the home value rises 20%, it’s now worth $480,000.

- If you paid down the loan to, say, $335,000 (illustrative), your equity is:

$480,000 − $335,000 = $145,000 in equity.

That’s your down payment plus appreciation plus paydownstacked together like financial lasagna.

This is why homeowners often feel like equity “shows up” suddenly. It doesn’t. It accumulates, quietly, then gets

noticed when someone runs the numbers.

The reality check: equity is real wealth, but it has real risk

If equity were a superhero, its weakness would be “market prices.” Equity can shrink if home values fall, and the

risk is higher for recent buyers with small down payments, or owners who borrowed heavily against their home.

Watch-outs homeowners sometimes underestimate

-

Price softness happens locally: Even when national indexes look stable, certain metros can cool

quickly if inventory rises or demand drops. -

Property taxes and insurance can bite: Rising values can push taxes up, and insurance costs can

jumpespecially in high-risk regions. -

Debt secured by your home is serious: Miss payments on unsecured debt and you have a problem.

Miss payments on debt tied to your home and you may have a crisis.

The goal isn’t to fear equityit’s to respect it. Treat it like a power tool: incredibly useful, but not something

you wave around while distracted.

What 2026 might mean for homeowner equity

Looking into 2026, the equity story will likely depend on three moving pieces:

home price appreciation, mortgage rates, and inventory.

Mortgage rates shape demand (and moves)

Rates influence affordability and the willingness to list a home. If rates drift lower, more buyers may step in and

more sellers may finally movepotentially increasing transactions without requiring huge price declines. If rates

stay elevated, the lock-in effect can persist, keeping inventory tighter and supporting prices.

Inventory is the wild card

Gradual inventory gains can cool bidding wars without triggering a collapsemore like letting steam out of the pot

instead of dropping it in the sink. That kind of environment can still allow modest appreciation, which supports

equity, just at a slower pace.

Equity growth may be slowerbut the base is huge

Even modest appreciation on top of already-elevated home values can keep equity levels high. And for many households,

simply paying down principal continues to build equity regardless of whether prices are sprinting or power-walking.

How to use equity wisely: a practical “no regrets” checklist

- Know your goal: debt payoff, renovation, emergency buffer, education, business capital, etc.

- Keep a cushion: avoid borrowing to the absolute maximumlife happens.

- Compare products: fixed vs. variable, fees, draw periods, repayment terms.

- Run the monthly payment scenario: especially with variable-rate HELOCs.

- Don’t borrow for stuff that disappears: equity is better spent on long-lived value than short-lived toys.

- Remember the exit plan: if you plan to sell soon, keep borrowing decisions aligned with timing.

Most of all, treat equity like a strategic resourcenot an invitation to upgrade every appliance to “smart”

and then wonder why your toaster needs a firmware update.

Homeowner experiences: how equity wealth feels in real life

Below are a few composite experiencesbased on common homeowner situationsshowing how equity

tends to show up in everyday decisions. Names and details are fictional, but the patterns are very real.

The “We Didn’t Mean to Get Rich” Remodel

Dana and Mike bought a starter home in 2017 and planned to “move up in five years.” Then prices surged, rates rose,

and suddenly their starter home came with a golden handcuff: a low-rate mortgage and a monthly payment that looked

downright cute compared to 2025 listings. They checked their estimated value and realized they had far more equity

than they expected. Instead of moving, they used a modest home equity loan to renovate the kitchen and add a small

office nook. The funny part? Their original plan was to leave for more space, but equity made staying feel like the

smarter upgrade. They didn’t “cash out” their futurethey used a portion of it to make the home fit their life now,

while keeping a healthy buffer.

The HELOC-as-a-Toolbox Strategy

Monica, a single homeowner, described her HELOC the way some people describe a generator: “I hope I never need it,

but I sleep better knowing it’s there.” She didn’t draw on it for vacations or gadgets. Instead, she set it up after

she’d built substantial equity so she could handle the unexpected: HVAC failure, surprise medical costs, or a

temporary job gap. When her water heater died at the worst possible moment, she used the line, paid the contractor,

and then paid herself back aggressively over several months. Her biggest takeaway wasn’t the moneyit was the

control. Equity can feel like financial breathing room when it’s treated as a backup plan, not a lifestyle plan.

The “Equity Isn’t Cash” Lesson

Kevin bought in 2022 with a smaller down payment. He watched home values in his area flatten out while property taxes

and insurance nudged upward. His equity still existed, but it didn’t feel like a jackpot; it felt like a slow-building

foundation. When he looked into borrowing, he discovered that “tappable” equity wasn’t as large as the online estimate

suggested once lenders factored in loan-to-value limits and fees. The experience taught him a valuable (and mildly

annoying) truth: equity is real wealth, but converting it to spending power has rules. He shifted focus to building

equity the old-fashioned wayextra principal payments when possiblebecause it was something he could control.

The Retirement Reframe

For Linda and James, equity changed how they viewed retirement timing. They didn’t want to sell immediately, but

knowing their home had substantial equity made other planning easier: they could downsize later, relocate to a cheaper

region, or use a smaller equity-based loan for home modifications as they aged. Their story highlights a quieter use

of equity: it’s not always about pulling money out. Sometimes it’s about having options. Equity can be a “Plan B”

that reduces anxiety, even if it never becomes a check in your hand.

These experiences share a theme: homeowner equity wealth is most powerful when it expands choices without creating

new pressure. The best equity stories aren’t the flashiestthey’re the ones where people use equity to solve a real

problem, protect cash flow, or invest in long-term value, and then go back to living their lives without their house

turning into a monthly payment monster.