Table of Contents >> Show >> Hide

- From Random Walks to Random Watches

- Trading Places: When Wall Street Becomes a Comedy

- A Wealth of Common Sense: The Grown-Up in the Room

- Putting It All Together: Your Own “Random Watch” Strategy

- Learning From the Movie, the Book, and the Blog

- of Real-World Experience: What a “Random Watch” Feels Like

- Conclusion: Let the Market Walk, You Just Watch (Calmly)

If you’ve ever stared at a stock ticker and thought, “This might as well be The Matrix,” you’re in good company.

Between classic investing books like A Random Walk Down Wall Street, movie chaos in Trading Places,

and the plainspoken wisdom of the blog A Wealth of Common Sense, Wall Street can feel like a mash-up of

Ivy League math, Hollywood comedy, and Midwestern common sense.

This article takes a “random watch” down Wall Streetpart movie night, part reading list, part real-world guideto

show how these three pillars can help you invest smarter. We’ll use the film Trading Places as a fun

backdrop, plug into the ideas behind A Random Walk Down Wall Street, and filter it all through the

practical lens of common-sense investing.

From Random Walks to Random Watches

First, let’s clear something up: a “random walk” isn’t you wandering around lost on Wall Street with a latte.

In finance, it’s the idea that stock prices move in ways that are largely unpredictable in the short term.

On any given day, prices jump around based on news, expectations, fear, and pure noise.

You can watch the market religiously, but it doesn’t mean you can consistently outguess it.

A Random Walk Down Wall Street popularized this idea by arguing that most investors – including

professionals – struggle to beat the market after costs. The more you trade, the more friction (fees, taxes,

bad timing) eats your returns. That’s why the book champions simple strategies like:

- Owning broadly diversified index funds instead of chasing hot stocks.

- Holding for the long term rather than trying to time every wiggle in the chart.

- Ignoring daily noise and focusing on your plan instead of market drama.

When you put this together, a “random watch” down Wall Street looks less like day-trading on three monitors and

more like glancing at your portfolio now and then to make sure it still matches your goals.

Think of it as checking the weather, not obsessively refreshing the radar every 60 seconds.

Trading Places: When Wall Street Becomes a Comedy

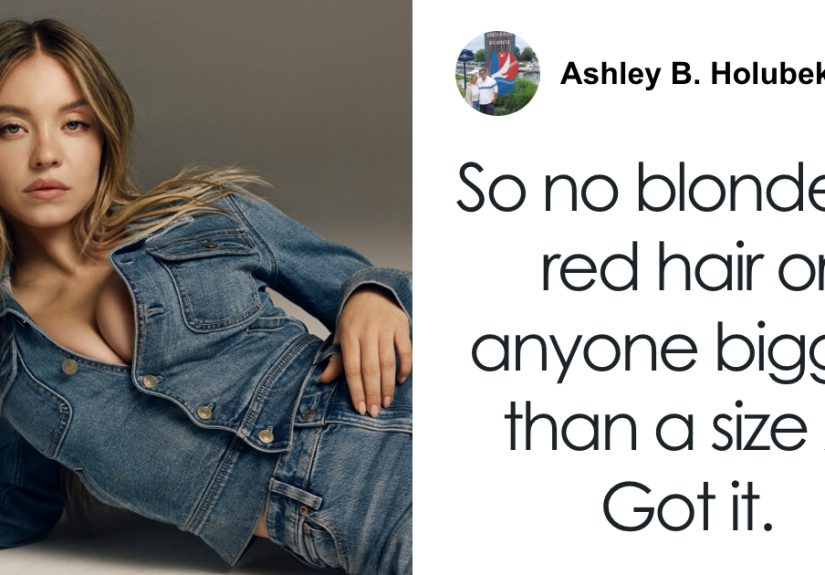

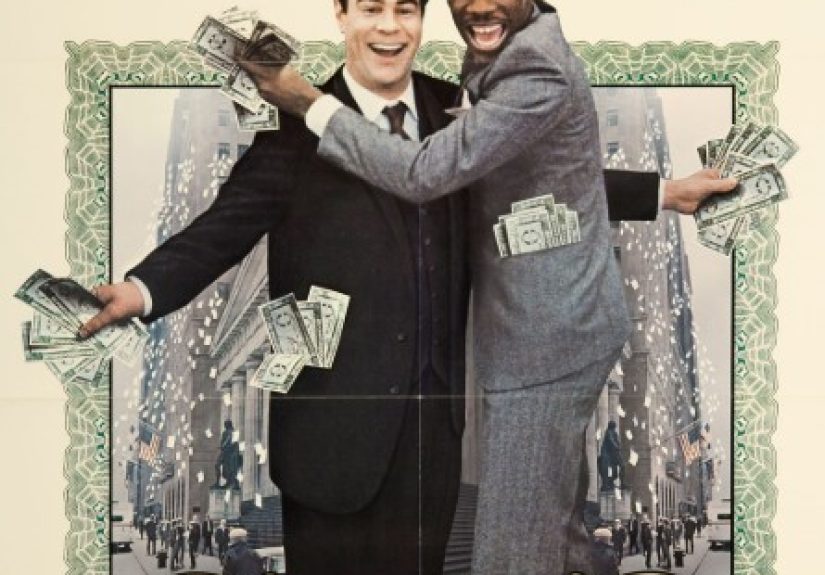

Now cue Trading Places, the 1983 comedy where a wealthy commodities broker and a street hustler switch lives

thanks to a cruel bet by two rich brothers. It’s funny, outrageous, and surprisingly educational if you watch it with

your “investor brain” turned on.

What the Film Accidentally Teaches About Markets

Beneath the jokes and disguises, Trading Places shows a few uncomfortable truths:

-

Information is powerful. The villains try to profit off secret crop reports. In real life,

insider trading is illegal for a reason: markets price in public information quickly, so only unfair,

non-public information gives a guaranteed edgeand that’s exactly what regulators go after. -

Leverage cuts both ways. The climactic trading scene shows fortunes made and lost in minutes

using futures contracts. That’s leverage in action: small price moves, huge dollar impacts. Great when you’re right;

brutal when you’re wrong. -

Greed makes people do dumb things. The Duke brothers let greed override prudence.

They overbet, underestimate risk, and blow up. Sound familiar? That’s the plot of many real-life financial crises.

If A Random Walk Down Wall Street is the sober professor explaining why markets are hard to beat,

Trading Places is the rowdy cousin showing what happens when you think you’re smarter than everyone else

and push your luck too far.

A Wealth of Common Sense: The Grown-Up in the Room

Somewhere between academic theory and movie mayhem lives the very practical philosophy behind

A Wealth of Common Sense. The core message is delightfully unglamorous:

most people don’t need exotic strategiesthey need a simple plan they can actually stick with.

What “Common Sense” Investing Looks Like

Common-sense investing tends to share a few key traits:

-

Simplicity over complexity. Broad index funds, reasonable asset allocation,

automatic contributions. Not 47 positions in niche ETFs you can’t pronounce. -

Process over prediction. You accept that you can’t predict the next crash or rally,

so you focus on a repeatable process: rebalancing, saving regularly, and keeping costs low. -

Behavior over brilliance. The real edge is not secret formulas;

it’s avoiding panic in downturns and FOMO in bubbles.

Put differently: the math matters, but your nervous system matters more.

A portfolio you can hold through ugly markets will usually beat a “perfect” portfolio you abandon at the first scare.

Putting It All Together: Your Own “Random Watch” Strategy

So how do you combine the lessons from A Random Walk Down Wall Street,

the chaos of Trading Places, and the calm of A Wealth of Common Sense?

Here’s a practical framework for real-world investors.

1. Admit You Can’t See the Future (And That’s Okay)

Start with humility: you don’t know where the S&P 500 will be next month.

Neither does your neighbor, your coworker, or that influencer shouting on social media.

That doesn’t mean investing is pointless. It means your strategy should work

without needing perfect predictions. You build something that’s robust to uncertainty:

diversified, low-cost, and aligned with your time horizon.

2. Own the Market Instead of Outguessing It

One of the cleanest takeaways from random walk thinking and common-sense investing is this:

if you can’t reliably beat the market, consider owning it. That usually means:

- A total U.S. stock market index fund or S&P 500 index fund.

- Possibly an international index fund for broader diversification.

- Bonds or cash-like assets matched to your need for stability and income.

It’s not flashy. There’s no secret orange juice report. But boring often beats brilliant

once you account for taxes, fees, and human error.

3. Use Risk Like Hot Sauce, Not Like Soup

Risk is like hot sauce: a little can improve the recipe; too much will make you regret your life choices.

Leveraged trades, concentrated bets, options, and narrowly focused sector plays all fall into the

“handle with care” category.

That doesn’t mean you can never take risk. It means:

- You understand the downside before you hit the “buy” button.

- You limit risky positions to a small part of your overall portfolio.

- You never risk money you can’t afford to see drop 50% or more.

In other words, don’t reenact the margin call scene from Trading Places in your brokerage account.

4. Protect Yourself From Your Own Brain

Behavioral mistakes are where many investors quietly lose the plot.

Common troublemakers include:

- Overconfidence: believing a few good calls mean you “get” the market now.

- Loss aversion: panicking at normal volatility and selling at the bottom.

- Recency bias: assuming whatever just happened will keep happening forever.

To counteract this, you can:

- Write down an investment policy for yourself (even a one-page version).

- Automate contributions so you invest through good and bad markets.

- Check your portfolio on a schedule (say, once a month or once a quarter),

not every five minutes.

That’s where the “random watch” idea really shines: you don’t obsess over every tick;

you zoom out and make decisions at a human pace.

Learning From the Movie, the Book, and the Blog

When you align these three sources, a surprisingly consistent picture appears:

- The movie shows how greed, leverage, and overconfidence can destroy fortunes fast.

-

The book argues that markets are hard to beat and that simple, diversified strategies

usually win long term. -

The blog-style “common sense” approach emphasizes behavior, costs, and clarity

over complexity and hype.

Together, they nudge you toward a practical philosophy:

accept uncertainty, avoid unnecessary complexity, and build a strategy that survives your own emotions.

of Real-World Experience: What a “Random Watch” Feels Like

Theory is nice, but what does all this look like in everyday life?

Imagine two investors: we’ll call them Louis and Billy, in honor of Trading Places.

Louis is the spreadsheet warrior. He jumps from strategy to strategy depending on what’s trending:

growth stocks this year, options next year, crypto the year after that. His watchlist is longer than his grocery list.

He checks his portfolio multiple times a day and reads market commentary like it’s breaking news about his own life.

When the market rallies, he feels like a genius. When it drops, he feels personally attacked.

Billy takes the common-sense route. He read a few classic investing books,

skimmed some blog posts, and decided on a simple target: a diversified mix of stock and bond index funds.

He set up automatic contributions from his paycheck, defined rough ranges for his allocation

(say, 70% stocks / 30% bonds while he’s still far from retirement), and wrote down one rule for himself:

“Don’t make big changes based on fear or excitement.”

Over a single week, Louis looks clever. He might catch a hot stock or a short-term swing and brag about it.

Over a single year, it’s harder to tell. Some of his bold plays hit, others flop, and his returns are noisy.

Over a decade, though, the pattern often changes. Taxes, trading costs, bad timing, and emotional decisions

eat away at his wins. He may have memorable stories but uneven results.

Billy’s experience is less dramatic. Some years his statement looks great; some years it looks painful.

But because his portfolio is broadly diversified and he keeps adding to it, the long-term trend is upward.

He is not trying to outsmart markets every day. He’s simply letting capitalism do the heavy lifting while he

focuses on his career, family, and life outside a stock chart.

Living a “random watch” philosophy doesn’t mean ignorance. Billy still learns.

He reads about interesting companies, follows big economic stories, and occasionally watches movies

like Trading Places and smiles at how wild finance can be.

The difference is that he treats market drama as entertainment and education, not as instructions.

He also builds small guardrails around himself. For example:

- He avoids looking at his portfolio during extreme volatility unless he needs to rebalance.

- He talks through big decisions (like changing his savings rate or retirement age)

with a trusted friend, partner, or advisor. - He reminds himself that long-term wealth comes from time in the market,

not heroic guesses about tomorrow’s open.

The funny part? From the outside, Billy looks “boring.”

But over 20 or 30 years, that boring strategy often produces very non-boring outcomes:

financial independence, less stress, and fewer sleepless nights over every market headline.

That’s the quiet magic of combining random walk thinking, common-sense investing, and a light touch of

Wall Street comedy. You don’t need to outplay the market like a movie hero. You just need a simple plan,

a bit of discipline, and enough humility to accept that the market doesn’t owe you predictability

only opportunity.

Conclusion: Let the Market Walk, You Just Watch (Calmly)

Wall Street can absolutely feel like a circuspart drama, part comedy,

sometimes a little horror. But you don’t have to live on the roller coaster.

By borrowing ideas from A Random Walk Down Wall Street, laughing at the extremes in

Trading Places, and applying the steady voice of A Wealth of Common Sense,

you can build an investing approach that is resilient, realistic, and surprisingly relaxed.

Let prices wander. Let headlines shout. Your job is simpler:

set up a sensible portfolio, automate what you can, and check in often enough to stay on track

not so often that every tick feels like a personal verdict. That’s the heart of a

“random watch down Wall Street”: you respect the market, but you don’t let it run your life.