Table of Contents >> Show >> Hide

- First Things First: What Does It Mean to “Double Off a Bear Market Bottom”?

- A Historical Tour: How Fast Has the Market Doubled After Big Crashes?

- So… How Long Does It Usually Take to Double?

- Why Can the Market Double So Quickly After a Bear Market?

- What This Means for Long-Term Investors

- Experiences and Lessons From Living Through Bear Markets

- Bringing It All Together

If you’ve ever watched your portfolio tumble in a bear market and thought, “There goes my retirement… and my sanity,” you’re not alone. A drop of 20% or more in the stock market feels catastrophic in the moment. But here’s the twist: history shows that from those depressing bear market bottoms, the stock market often goes on to doublesometimes surprisingly fast.

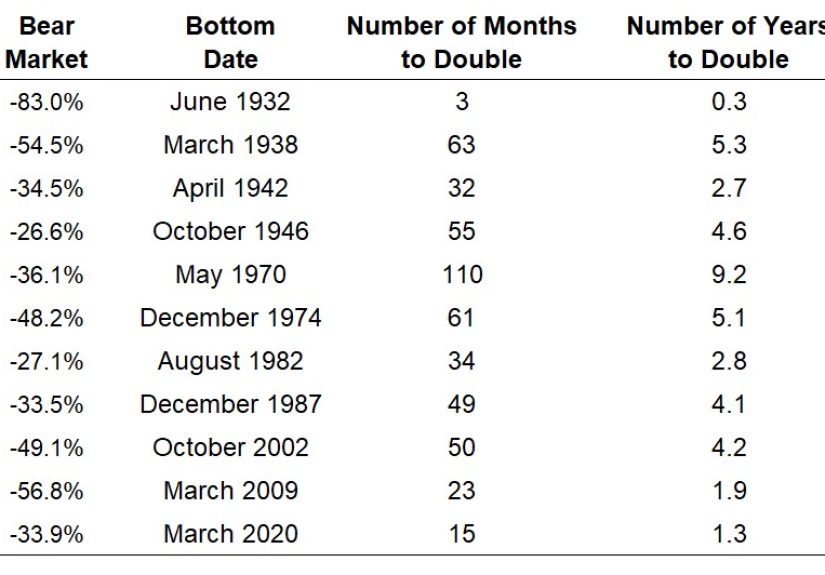

This idea was explored in detail by Ben Carlson on his blog A Wealth of Common Sense, where he looked at how long it took the U.S. market to gain 100% off past bear market lows. In this article, we’ll unpack his findings, blend them with data and perspectives from major U.S. sources like Vanguard, Schwab, MFS, Investopedia, and others, and translate it all into practical lessons you can actually use.

So, how long does it really take for the stock market to double after a bear market bottom? Let’s walk through the history, the math, and the mindsetall with a little common sense and a dash of calm.

First Things First: What Does It Mean to “Double Off a Bear Market Bottom”?

A bear market is usually defined as a drop of 20% or more from a recent peak in a broad index like the S&P 500. The bear market bottom is the low point where prices finally stop falling and start a sustained move higher.

When we say the market “doubled off the bottom,” we mean this:

- Take the lowest level of the index during a bear market.

- Measure how long it takes for that index level to increase by 100%.

- No cherry-picking individual stocksthis is about the broad U.S. market (think S&P 500).

For example, after the COVID crash in early 2020, the S&P 500 bottomed on March 23, 2020. By mid-2021, it was up roughly 100% from that levelmeaning the market doubled in a little over 15 months. That’s lightning fast for an index tracking trillions of dollars in value.

A Historical Tour: How Fast Has the Market Doubled After Big Crashes?

Let’s look at some of the major bear markets in U.S. history and how long it took the market to double from those lows. Numbers below focus on the S&P 500 or comparable broad U.S. stock indices.

The Great Financial Crisis (2007–2009): Roughly 23 Months

During the 2007–2009 financial crisis, the market fell about 56% from peak to trough, bottoming on March 9, 2009. From there, the rebound was ferocious:

- The S&P 500 surged nearly 70% by the end of 2009 alone.

- By late January 2011, the market had doubled (up 100%) from that March 2009 bottom.

That’s about 23 months, just under two years for a complete double off a historic crisis lowfaster than many investors expected in real time.

The Dot-Com Bust (2000–2002): Roughly 50 Months

The dot-com bubble was a slow-motion kind of pain. From early 2000 to late 2002, the S&P 500 fell about 50% as tech valuations collapsed and corporate scandals (like Enron) shook confidence.

The bottom came in October 2002. From there:

- The S&P 500 did not reach a full 100% gain from its 2002 low until roughly January 2007.

- That’s about 50 months, or a little over four years, to double.

Compared with the post-2009 recovery, that’s a much slower grindbut still a reminder that patience often wins out.

The 1987 Crash: About 49 Months

On Black Monday in October 1987, the market plunged more than 20% in a single day, with the broader drawdown exceeding 30%. The S&P 500 didn’t fully bottom until December 1987.

Afterward:

- The market logged strong returns in 1988 and 1989, with some double-digit corrections along the way in 1990.

- The S&P 500 finally hit a 100% gain from its 1987 low in December 1991, about 49 months later.

Again, a double took around four yearsnot overnight, but not a lost decade, either.

COVID Crash (2020): Just Over 15 Months

The COVID bear market in early 2020 was one of the fastest in history. The S&P 500 fell more than 30% in about a month, then snapped back aggressively as unprecedented monetary and fiscal stimulus flooded the system.

The low was on March 23, 2020. From there:

- By July 2021, the index was up roughly 99% from the bottomclose enough to call it a double.

- That’s just a bit over 15 months.

In Ben Carlson’s analysis, this made the 2020–2021 rebound one of the fastest doubles off a major bear market bottom in modern historysecond only to an extreme case in the 1930s.

The Great Depression (1930s): A Wild 3-Month Double

Sometimes markets don’t just recoverthey go full rocket ship. After the brutal 80%+ crash that started in 1929, U.S. stocks finally bottomed on June 1, 1932.

What happened next is almost unbelievable by today’s standards:

- Stocks were essentially flat for the rest of June.

- Then, in July and August 1932, they exploded higher, rising roughly 92% in two months.

- By early September 1932, the market had more than doubled from the June lowin about three months.

This is the fastest historical double off a bear market bottom that Carlson could find, and it came after the worst crash in U.S. market history. It’s a reminder that the more oversold markets get, the more dramatic the eventual rebound can be.

Other Historical Bear Markets: Slower but Still Powerful

Carlson also examined bear markets in 1973–1974, 1968–1970, 1946, 1940–1942, and 1937–1938. None of those rebounds doubled in 15 months or less like the COVID or Great Depression episodes.

Broadly speaking, research from firms like Vanguard, Schwab, and MFS shows that:

- The average bear market in U.S. stocks has lasted around 11–15 months.

- It often takes about 2 to 3 years for the market to recover to its prior peak.

- Doubling from the bottom often happens sometime after that recovery, depending on how deep the decline was and how strong the following bull market is.

So… How Long Does It Usually Take to Double?

Based on historical data from major U.S. bear markets:

- The fastest doubles (Great Depression rebound, COVID crash) have taken about 3–15 months.

- More “normal” big bear markets (1987, dot-com bust) took around 4 years to double off the lows.

- Some deep or complicated periods (like parts of the 1970s) took longer and involved choppy sideways markets before sustained gains arrived.

If you want a rough rule of thumb, you might say:

Historically, it has often taken somewhere between two and five years for the U.S. stock market to double off a major bear market bottomthough in extreme cases, it has happened much faster.

This is not a promise or a prediction; it’s simply a historical pattern. As every prospectus loves to remind you, past performance is no guarantee of future results.

Why Can the Market Double So Quickly After a Bear Market?

The speed of some recoveries can feel irrational. But there are a few logical forces at work.

1. The Math of a Rebound After a Big Drop

If an index falls 50%, it doesn’t need to rise 50% to get back to where it startedit needs to rise 100%. That means the period after a deep bear market is often filled with large percentage gains as prices claw their way higher.

Historically, the S&P 500 has delivered about a 10% average annual return over long periods (before inflation), with around 6–7% real returns after inflation. When valuations are depressed and pessimism is high, the forward returns from that point can be even higher than average.

2. Policy Responses and “Don’t-Fight-the-Fed” Moments

In many modern bear markets, especially 2008–2009 and 2020, governments and central banks responded aggressively with lower interest rates, liquidity programs, and fiscal support. Those actions don’t guarantee anything, but they can shorten recessions and stabilize markets, helping fuel rapid snapbacks.

3. Human Behavior: Panic, Then FOMO

Bears and bulls are as much about psychology as they are about earnings. In downturns, people panic, sell, and move to cash. Once markets start to rebound and headlines shift from “end of days” to “new highs,” some of those same investors scramble to get back inoften after a big chunk of the recovery is already over.

Research from Schwab and others has repeatedly shown that investors who try to time the marketjumping out during crashes and back in latertend to underperform those who simply stay invested through the turbulence.

What This Means for Long-Term Investors

Knowing that the market has often doubled off bear market bottoms is comforting, but it only helps if you shape your behavior around that knowledge.

1. Bear Markets Are Normal, Not a Glitch

Historical analysis from Schwab, Vanguard, and others shows that bear markets and corrections are a built-in part of investingnot a sign that “the system is broken this time.” Since the late 1920s, the S&P 500 has seen dozens of corrections and more than 20 bear markets, yet long-term returns have remained strongly positive.

2. Time Horizon Matters More Than the Latest Headline

If your investing time frame is 10, 20, or 30 years, the fact that the market has historically recovered and often doubled within a few years of a major low is powerful perspective. For younger investors, downturns may be more opportunity than threat; for those near retirement, the focus shifts to diversification, withdrawal strategy, and risk managementnot panic selling at the bottom.

3. Staying Invested Beats Trying to Guess the Bottom

Most of the big gains that build doubles happen during a relatively small number of “strong” days and months. Missing them because you were sitting on the sidelines can dramatically reduce long-term returns.

This is why strategies like dollar-cost averaging and periodic rebalancing are so frequently recommended by large U.S. investment firms: they help you keep participating in recoveries without needing a crystal ball.

4. Doubling Isn’t GuaranteedBut History Has Rewarded Patience

There’s no iron law that says, “Buy at any bear market bottom and you’ll double your money in X years.” Some periods (like the aftermath of 1929 or the 1970s) were extremely challenging. But when you zoom out across nearly a century of U.S. data, you see a consistent theme:

Investors who stayed invested through bear markets were often rewarded with powerful recoveries, sometimes including doubles from the lows within a handful of years.

Experiences and Lessons From Living Through Bear Markets

Historical charts are great, but what does all of this look like in real life? Let’s walk through some composite “experiences” inspired by what many investors went through during the 2008–2009 crisis and the 2020 COVID crash.

The 2009 Investor Who Almost Gave Up

Imagine an investor in early 2009 who opened their statement and saw their portfolio down close to 50%. News headlines were full of bank failures, foreclosures, and talk of a second Great Depression. They were tired of the stress and seriously considered selling everything “until things felt safer.”

If they had sold in March 2009, they would have locked in those losses. But investors who gritted their teeth and stayed invested watched the S&P 500 not only recover but double from the March low in under two years. Many who stuck with a diversified portfolio and kept contributing saw their balances recover far faster than they expected.

The emotional experience? Terrifying at the timeembarrassingly obvious in hindsight.

The 2020 Crash: Blink and You Miss the Double

Fast forward to early 2020. The market dropped more than 30% in about a month as the world shut down. This time, many investors had just lived through 2008–2009 and thought, “Okay, here we go againthis will be a multi-year slog.”

So some sold, waited for “clarity,” and planned to buy when the economy looked better.

But the recovery came far faster than the economic news. Massive policy responses and investor expectations of a rebound pushed stocks sharply higher. Within about 15 months of the March 2020 bottom, the market had effectively doubled. Anyone who had moved entirely to cash near the lows and waited for a “perfect” reentry point often missed a big chunk of the rebound.

The emotional experience? Whiplash. One minute it felt like the world was ending; the next, people were asking, “How is the market at all-time highs again?”

The Long-Term Investor Who Treats Bear Markets as Sales

Now picture a different kind of investorsomeone with a 20+ year horizon who has internalized that bear markets are normal. When stocks fall 20%, 30%, or even 40%, they don’t feel excited, exactly, but they do see opportunity.

They keep a diversified portfolio, continue automatic contributions, and may even increase their savings rate during downturns. They don’t know the exact bottom. They don’t pretend to. They just know that history has rewarded investors who bought when valuations were lower and pessimism was high.

Later, when the market has not only recovered but doubled from the lows, they’re not surprisedit’s what they were planning for all along. For them, the big emotional edge is having a written plan before the storm hits.

The Key Emotional Lesson: Plan for Pain Before It Shows Up

It’s one thing to say, “I’ll stay invested during a 40% drop,” and another to actually live through it. That’s why many financial planners emphasize setting expectations before the next bear market:

- Understand that big drawdowns are part of long-term equity investing.

- Decide in advance how much volatility you can emotionally and financially handle.

- Build a diversified portfolio and cash buffer that matches your risk tolerance and time horizon.

When you know that markets have historically doubled off bear market bottomssometimes in a matter of a few years or lessit becomes easier to hold on when everyone around you is panicking.

Bringing It All Together

So, how long does it take for the stock market to double off a bear market bottom? History gives us a range:

- Extreme rebounds: 3–15 months (Great Depression rebound, COVID crash).

- More typical major bear markets: around 2–5 years to double from the low.

But the more important takeaway isn’t the exact number of monthsit’s the mindset:

- Bear markets are a feature, not a bug.

- Recoveries can be surprisingly powerful, and sometimes shockingly fast.

- If you bail out at the bottom, you risk missing the very gains that drive long-term wealth building.

No one knows how the next bear market will play out, or how long the next double will take. But if history is any guide, investors who stay diversified, stay patient, and stay invested give themselves the best odds of benefiting when the market eventually moves from fear back to optimism.