Table of Contents >> Show >> Hide

If you’ve ever stared at your retirement account and thought, “That’s it?”, you are very much not alone. Americans are told from their first paycheck to “save more for retirement,” yet survey after survey shows that many people are falling short of the nest egg they’ll need. We don’t have a savings problem because people are lazy or bad at math; we have a savings problem because humans are wired for the present, while retirement lives way out in “future me” land.

The good news: we actually know a lot about what works. Behavioral economists, retirement researchers, and financial planners have spent decades running experiments and combing through 401(k) data. Their conclusion is surprisingly hopeful: if you make saving easy, automatic, and painless, people do save more for retirement. In other words, we don’t just need better lectures about compound interest. We need better systems.

Inspired by the practical approach of A Wealth of Common Sense, this article looks at why people don’t save enough, what actually moves the needle, and how employers, policymakers, and everyday savers can nudge behavior in the right direction without making life miserable in the present.

Why Is It So Hard to Save for Retirement?

Before we talk about solutions, we have to be honest about the problem. It’s not just “people make silly choices.” There are real structural and psychological barriers that show up in almost every study on retirement savings.

Structural hurdles: when there’s nothing left to save

One of the simplest reasons people don’t save more: there isn’t much money left after the basics. Many households face high rents or mortgages, student loan payments, childcare, and healthcare costs. By the time the essentials are covered, telling people to carve out 15% for a 401(k) can sound less like a helpful suggestion and more like a cruel joke.

On top of that, not everyone has access to a solid workplace retirement plan. Small businesses may not offer a 401(k), gig workers juggle multiple income streams, and lower-wage employees are less likely to be covered by traditional employer plans. When you don’t have payroll deduction or employer matches, saving for retirement becomes one more item on an already chaotic to-do list.

Behavioral hurdles: the human brain is not a retirement robot

Even when people can save, our brains get in the way. Behavioral economics has cataloged a greatest hits list of biases that make retirement saving particularly painful:

- Present bias: We heavily prioritize today’s comfort over tomorrow’s security. A new phone or a vacation is tangible. Retirement at 67 is hazy.

- Limited attention: Sign-up packets, investment menus, and fine print are mentally exhausting. When in doubt, we do nothing.

- Loss aversion: Seeing a smaller paycheck feels like a loss, even if that money is going to our future selves. We’re wired to avoid that sting.

- Inertia: Once we set a savings rate (including zero), we tend to stick with it for years, even when our income rises.

This cocktail of biases means that “just be more disciplined” is not a strategy. It’s wishful thinking. To get people to save more for retirement, we have to design systems that work with human nature, not against it.

The Power of Smart Defaults

If you remember nothing else about retirement savings policy, remember this: defaults are destiny for a lot of people. Whether the default is “you’re out unless you sign up” or “you’re in unless you opt out” has a huge impact on who ends up saving.

Automatic enrollment: from opt-in to opt-out

In traditional 401(k) plans, the default used to be simple: you started your job with a blank form and a choice. Fill it out and you’re in; ignore it and you’re out. And people did what humans do best when faced with paperwork and long-term decisions: nothing.

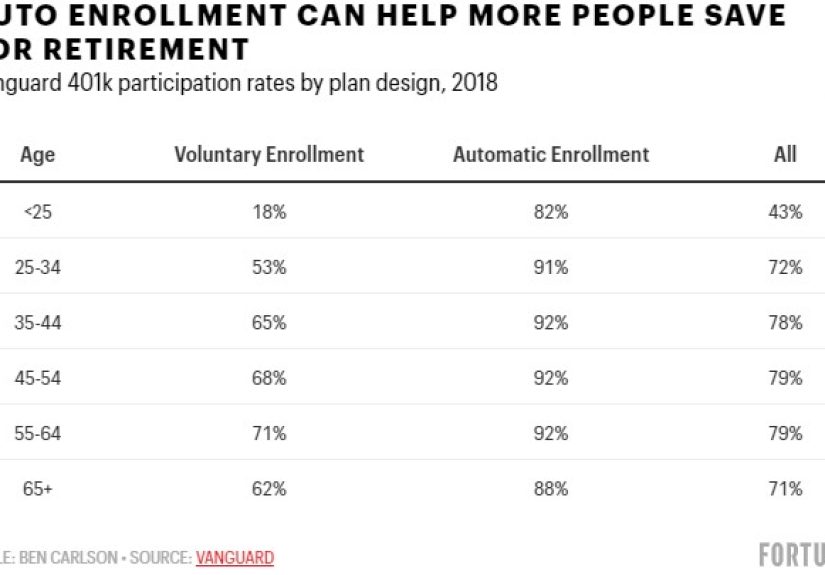

Automatic enrollment flips that script. New employees are enrolled in the retirement plan by default at a preset contribution rate, often 3% to 6% of pay, unless they actively opt out or change it. Suddenly, doing nothing means you are saving.

Studies of plans that adopt automatic enrollment find that participation rates jump dramatically, especially among younger and lower-income workers who are usually the least likely to sign up on their own. Once people see that saving is happening automatically, many simply stick with it. It’s not that they’ve become retirement fanatics overnight; it’s that the easiest path now happens to be the financially smarter one.

Automatic escalation: turning raises into retirement money

Automatic enrollment gets people in the door, but the default savings rate might not be enough on its own. That’s where automatic escalation comes in. Auto-escalation gradually increases your contribution rate over time, often by 1% each year, usually up to a target like 10% or 15% of pay.

The beauty of auto-escalation is that it often syncs with pay raises. If your salary goes up by 3% and your savings rate increases by 1%, your paycheck still grows just a little less. That softens the perception of loss and leans on our natural tendency to adapt quickly to slightly smaller take-home pay, as long as life still feels manageable.

Data from large plan providers show that many participants who start low and escalate over time end up with strong overall savings rates without ever having to log in and constantly fiddle with their contributions. The system quietly nudges them upward.

“Save More Tomorrow”: the classic behavioral finance nudge

One of the most famous ideas in this space is the “Save More Tomorrow” (SMarT) program created by Richard Thaler and Shlomo Benartzi. The concept is delightfully simple: instead of asking people to increase their savings rate today which feels like a painful cut ask them to commit now to raising their contributions later, whenever they get a raise.

This pre-commitment strategy taps into three powerful principles:

- We’re more willing to sacrifice future money than current money.

- Pay raises feel like “found money,” making it easier to divert part of them to savings.

- People are more likely to follow through if they make a decision once and let the system handle the rest.

Companies that implemented Save More Tomorrow saw participants gradually ramp their savings to levels they almost never would have chosen on day one. The workers didn’t become overnight budgeting geniuses; they just made one smart choice that kept compounding in the background.

Practical Ways to Get People to Save More

So what does all this mean in the real world? Let’s break it down into what employers and policymakers can do, and what individuals can do, even if their employer isn’t exactly on the cutting edge.

For employers and policymakers

- Make saving the default: Adopt automatic enrollment with an opt-out rather than opt-in. Set a reasonable starting contribution rate and default investment, so employees get a functional plan without a homework assignment.

- Use auto-escalation as the “silent upgrade”: Build in automatic annual increases to contribution rates, especially timed with annual raises. Let employees opt out if they truly can’t afford it, but keep the default moving in the right direction.

- Design simple, sensible investment menus: Too many choices create decision paralysis. Target-date funds or well-diversified default portfolios let less confident investors get a solid option without needing a finance degree.

- Pair long-term savings with short-term resilience: Give workers ways to build emergency savings alongside retirement savings. If people are constantly raiding their 401(k)s for emergencies, long-term progress stalls. Sidecar savings accounts or payroll-deducted emergency funds can help.

- Communicate with plain language and concrete examples: Instead of complex charts, show what a 1% increase in contributions might look like in dollars per paycheck and future balance. People respond better to “this is one streaming subscription a month” than to abstract percentages.

- Consider incentives that match behavior, not just participation: Matching contributions, small bonuses for increasing deferrals, or gamified milestones can nudge participation in a way that feels rewarding rather than punitive.

For individuals and households

Even if you’re not designing a national retirement policy, you still have more control than you might think. You don’t have to build the perfect plan; you just need a workable one that you can stick to.

- Start where you are, not where you “should” be: If 15% of income feels impossible, try 3% or 5%. The key is beginning. You can always build on it.

- Use your own “Save More Tomorrow” plan: Decide now that every time you get a raise, you’ll send part of it to your retirement account before your lifestyle grows to match your new paycheck.

- Automate everything you can: Use payroll deductions, automatic transfers to IRAs, and recurring contributions. If you have to manually decide every month whether to save, the couch and takeout menus will win way too often.

- Anchor yourself with simple rules of thumb: Concepts like the “rule of 25” (needing around 25 times your annual expenses in retirement assets) or targeting double your salary by age 40 and so on aren’t perfect, but they give you a direction and a way to measure progress.

- Shrink the decision, don’t overthink it: You don’t need to know the perfect fund, tax strategy, and retirement date to increase your contribution by 1% this month. Do the simple, obvious thing first; fine-tune later.

- Protect your progress: Try to keep hardship withdrawals and loans from retirement accounts as a true last resort. Build a small emergency fund so that every flat tire doesn’t come out of your future self’s wallet.

Rethinking “How Much Is Enough?”

One reason people give up on retirement saving is that the target numbers sound absurd. When you hear that you “should” have a million dollars or more, it can feel completely detached from your reality especially if you’re starting late or juggling big expenses.

Instead of panicking about the ultimate number, break it into manageable steps:

- Estimate your annual spending in retirement, then subtract Social Security or pensions. That gap is what your savings needs to cover.

- Use rules of thumb like the 4% withdrawal rule or the rule of 25 as a starting point, not a commandment.

- Focus on increasing your savings rate over time, not hitting a perfect balance every year.

- Remember that working a bit longer, downsizing housing, or reducing big fixed expenses can lower the amount you ultimately need.

In the spirit of “a wealth of common sense,” the most realistic plan is usually the one you can stick to through different market cycles and life changes, not the one that looks perfect in a spreadsheet.

Real-World Experiences: What Actually Gets People to Save More

Concepts and studies are helpful, but it’s often stories and lived experiences that make the lessons stick. Here are a few common patterns that show up when people successfully move from “I’ll never be ready for retirement” to “I’m not perfect, but I’m on track.”

The auto-enrolled employee who forgot to be scared

Imagine a 25-year-old new hire. She starts at a company that automatically enrolls her in the 401(k) at 5% of pay, with a default target-date fund. She sees a slightly smaller paycheck, shrugs, and adjusts. There’s no drama, no agonizing over which fund to pick, and no moment where she has to psych herself up to turn money over to her future self.

Fast-forward 10 years. Between market growth, employer matches, and modest auto-escalation, she has a meaningful balance. When she logs in and finally looks, she’s pleasantly surprised and now motivated to increase contributions. Her “secret” wasn’t discipline; it was a system that quietly worked in her favor while she was busy living her life.

The mid-career saver who used raises as a reset button

Another common story: someone in their 40s realizes they’re behind. Their savings rate is low, and the retirement calculators are not kind. Instead of trying to jump from 4% to 15% overnight and blowing up their budget, they adopt a personal Save More Tomorrow strategy: every time their pay goes up, they increase their contribution rate by 1%–2%.

Over five or six years, their savings rate quietly creeps into the double digits. They still see paychecks rise, just not as fast as they might have, and their lifestyle doesn’t inflate as much. A decade later, they’ve transformed their trajectory not by one heroic act, but through a series of small, pre-decided nudges.

The couple who made peace with “good enough”

Then there’s the couple who sat down, looked at the million-dollar-plus targets floating around online, and felt defeated. Instead of throwing up their hands, they worked backwards from their actual life: What would a “good enough” retirement look like? Could they downsize, relocate to a lower-cost area, or prioritize experiences over luxury upgrades?

By adjusting expectations and focusing on controllable choices like eliminating high-interest debt, trimming a few recurring expenses, and locking in automatic contributions they built a plan that was realistic, not Instagram-worthy. The numbers may not impress a retirement calculator, but they’re far better than the alternative of doing nothing out of frustration.

What these experiences have in common

Across these examples, a few themes show up over and over:

- Action beats intention: The people who end up in better shape don’t necessarily start with more knowledge. They simply take small actions and let time do its work.

- Automation beats willpower: Systems that make the right choice the easy choice are more powerful than trying to “stay motivated” for 30 years.

- Progress beats perfection: Everyone’s savings journey includes detours job changes, kids, health issues. What matters is nudging your trajectory upward whenever you reasonably can.

Getting people to save more for retirement isn’t about shaming lattes or preaching austerity. It’s about acknowledging human behavior, building smarter defaults, and celebrating steady, imperfect progress. If we can do that at the household, employer, and policy level we give future retirees something more valuable than a perfect spreadsheet: a genuine shot at financial freedom.

Conclusion: A Common-Sense Path to Better Retirement Saving

When you strip away the jargon and the fear-mongering headlines, the core answer to “How do we get people to save more for retirement?” is surprisingly straightforward: make it easier to do the right thing than to do nothing.

Smart defaults like automatic enrollment and auto-escalation, behavioral tools like Save More Tomorrow, and clear, realistic communication can dramatically change outcomes, especially for workers who don’t have time or energy to obsess over their finances. At the individual level, adopting your own version of these ideas starting small, automating contributions, and using raises to increase your savings rate can turn retirement from an abstract worry into a concrete plan.

It won’t be perfect. It doesn’t have to be. But with a little behavioral insight and a lot of common sense, we can move a whole lot more people from “I hope it works out” to “I’m actually getting there.”