Table of Contents >> Show >> Hide

- Why Nasdaq Is Tightening the “Front Door” and the “Stay-in-the-House” Rules

- How a Nasdaq “Proposal” Becomes a Real Rule

- The Core Changes Nasdaq Has Proposed (and Why They Matter)

- 1) Raising the Minimum “Public Float” Value for Certain New Listings

- 2) Faster Suspension/Delisting for Extremely Small, Already-Deficient Companies (Proposed, Then Partly Pulled Back)

- 3) Stricter Listing Requirements for Certain China-Based Companies

- 4) Tighter Treatment of Minimum Bid Price Problems and Repeat Reverse Stock Splits

- 5) A New “Discretion” Tool: Denying Initial Listings Based on Manipulation-Risk Factors

- Who Feels the Impact the Most?

- A Practical Compliance Playbook (No Cape Required)

- Conclusion

- Experiences and Field Notes: What It Feels Like When Nasdaq Listing Standards Tighten (Bonus Section)

If you’ve ever wondered why stock exchanges have “listing standards” in the first place, here’s the simplest answer:

an exchange is basically saying, “Sure, you can hang out in our house… but you have to follow house rules.”

When Nasdaq proposes changes to listing standards, it’s not just swapping out fine print for different fine printit’s

trying to protect the quality, liquidity, and credibility of the market that investors assume they’re getting when they

see a Nasdaq ticker.

Over the last few years, Nasdaq and regulators have pointed to a recurring issue: certain very small, low-float listings

can trade in ways that look more like a roller coaster than a price-discovery mechanism. Add repeated compliance problems

(hello, minimum bid price), plus concerns about market manipulation patterns in a subset of micro-cap names, and you get a

predictable result: tougher rules, faster consequences, and more scrutiny up front.

Why Nasdaq Is Tightening the “Front Door” and the “Stay-in-the-House” Rules

Listing standards do two big jobs at once:

(1) they set a baseline for liquidityenough public float, enough holders, enough trading interestand

(2) they provide a framework for what happens when a company starts slipping below the line after it’s already listed.

In plain English: “Can you list?” and “Can you stay listed?”

Nasdaq’s recent proposals focus on the parts of the rulebook that tend to get stressed during speculative cycles:

tiny public floats, thin trading, and repeated “fixes” (like reverse stock splits) that keep a stock technically listed

while investors experience a not-so-technical reality.

How a Nasdaq “Proposal” Becomes a Real Rule

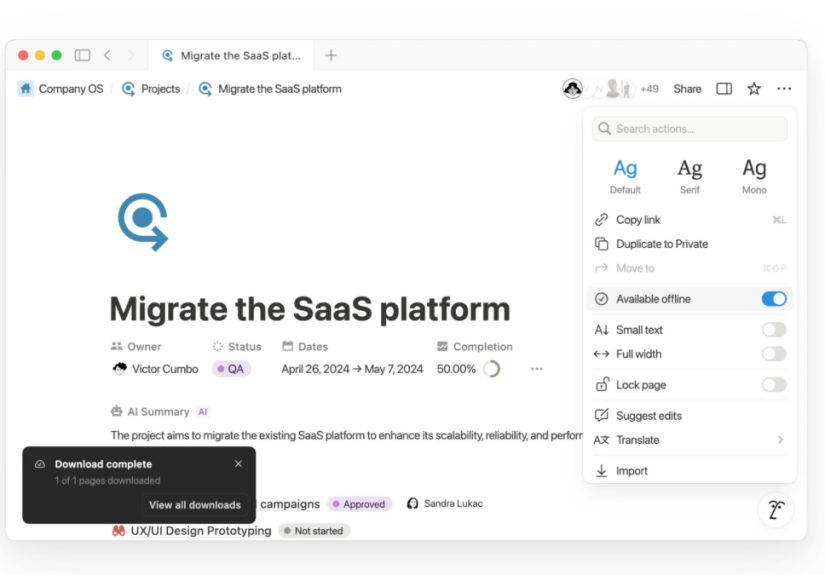

Step 1: Nasdaq files a proposed rule change with the SEC

Nasdaq is a self-regulatory organization (SRO). That means it can propose changes to its own rules, but the SEC reviews

those proposals. Most meaningful listing-rule changes go through a public notice-and-comment process, and the SEC can approve,

disapprove, or require modifications.

Step 2: The public gets a chance to comment

Proposals are typically published for comment (often via the Federal Register). That’s the window where investors, issuers,

lawyers, and market structure folks can weigh insometimes politely, sometimes in the tone of “please don’t do this to my cap table.”

Step 3: The SEC decides (sometimes with amendments)

Nasdaq may amend a proposal along the way. The SEC can approve the proposal as modified. Translation: the final rule can look

meaningfully different from the first draft, especially if the SEC pushes back on investor-impact or implementation details.

The Core Changes Nasdaq Has Proposed (and Why They Matter)

Nasdaq’s recent listing-standards agenda clusters into five themes:

stronger initial liquidity requirements, faster consequences for the smallest noncompliant listings, tougher requirements for

certain China-based listings, tighter treatment of repeat bid-price issues and reverse stock splits, and increased discretion

to deny initial listings when specific manipulation-risk factors show up.

1) Raising the Minimum “Public Float” Value for Certain New Listings

One headline proposal: raising the minimum Market Value of Unrestricted Publicly Held Shares (MVUPHS) to $15 million

for companies listing under the net-income based standard on both the Nasdaq Capital Market and the Nasdaq Global Market.

MVUPHS is essentially the market value of shares that are truly in public handsexcluding shares held by officers, directors,

or 10% owners, and excluding shares restricted from resale. It’s a liquidity proxy: more unrestricted public float generally

means a market that can absorb trades without wild price distortions.

Why now? Nasdaq has pointed out a practical side effect of earlier liquidity-rule changes: for IPO listings, MVUPHS must be

satisfied based on shares sold in the offering (not just “registered for resale” shares sitting in the background). Since that

change took effect, Nasdaq observed more companies trying to qualify under the net-income standard because it historically

required a lower MVUPHS thresholdmaking it easier for smaller deals to squeeze through the doorway.

Example: Imagine a small profitable company aiming for the Nasdaq Capital Market under a net-income standard.

Under the old threshold, a relatively small IPO could produce the required public float market value. Under a $15 million MVUPHS

threshold, the offering size (or price, or true public float) needs to be meaningfully larger, making it harder to list with an

ultra-thin float that’s vulnerable to price swings.

2) Faster Suspension/Delisting for Extremely Small, Already-Deficient Companies (Proposed, Then Partly Pulled Back)

Nasdaq also proposed an accelerated path for companies that are both (a) noncompliant with certain quantitative listing requirements

and (b) extremely small by market value measuresspecifically, a Market Value of Listed Securities (MVLS) below $5 million

for a sustained period (e.g., 10 consecutive business days in the versions described publicly).

The logic is straightforward: if a company is already deficient and its listed securities’ market value collapses below a very low

threshold, Nasdaq argues the usual “compliance period” may not be the right tool. The market has already delivered a pretty loud

signal about liquidity and viability, and keeping the ticker on an exchange may increase the risk of disorderly trading.

Here’s the nuance: in at least one SEC approval pathway related to Nasdaq’s MVUPHS changes, Nasdaq removed the accelerated

suspension/delisting portion via amendment and indicated it might resubmit that piece later. That’s a classic example of “yes to

tighter liquidity, but let’s slow down on automatic ejections.”

3) Stricter Listing Requirements for Certain China-Based Companies

Another major proposal: reintroducing and strengthening a minimum public offering proceeds requirement for companies that are

headquartered, incorporated, or principally administered in China (including Hong Kong and Macau), with Nasdaq using a facts-and-circumstances

test to determine where a company is “principally administered.”

The key requirements described publicly include:

-

IPO path: at least $25 million in gross proceeds to the company in a firm commitment

offering in the U.S. sold to public holders. - Business combination path: at least $25 million MVUPHS after the transaction.

- Direct listing limitation: eligibility restricted to the Nasdaq Global Select Market or Nasdaq Global Market (not the Capital Market) for direct listings.

- Transfers/uplists: at least $25 million MVUPHS plus at least one year of trading on the other market.

What’s the policy goal? Nasdaq has tied these proposals to market integrity and investor protection, pointing to concerns about

low-float listings and the higher friction involved when regulators and investors try to get information or remedies across borders.

The “$25 million” concept is basically: “If you want the Nasdaq label, bring enough liquidity to support a real market.”

4) Tighter Treatment of Minimum Bid Price Problems and Repeat Reverse Stock Splits

The minimum bid price requirement (the famous $1.00 line) is one of the most common continued-listing tripwires.

Companies typically get time to regain compliance, but Nasdaq and the SEC have increasingly focused on the pattern where a company

repeatedly cures bid-price deficiencies through reverse stock splitsonly to fall back below $1 again.

Several rule changes in recent years (and additional refinements) reflect a clear direction:

repeated “quick fixes” should not allow a security to trade on Nasdaq indefinitely while the underlying issue persists.

Key concepts regulators and Nasdaq have discussed/approved include:

-

No stay after a second compliance period: if a company uses the second compliance period and still fails,

an appeal may no longer keep the stock trading on Nasdaq during the review; it may trade OTC while the appeal is pending. -

Reverse split within the prior year: if a company falls below the bid price requirement after effecting a reverse split

in the previous year, it can be routed into delisting without a fresh compliance period. -

Two-year cumulative reverse split ratio trigger: Nasdaq has also used thresholds (like a 250-to-1 cumulative ratio over

two years) to deny additional compliance periods and move faster to delisting. -

No “double cure” loophole: if a reverse split cures bid price but creates another listing deficiency, the company may be

treated as still noncompliant until both issues are fixedpreventing a game of compliance whack-a-mole.

Example: A company falls below $1, gets a compliance period, then reverse-splits 1-for-50 to pop above $1.

If it later falls below $1 again within a year, newer rule logic may push the company directly into a delisting determination

rather than granting yet another long runway to “try again.”

5) A New “Discretion” Tool: Denying Initial Listings Based on Manipulation-Risk Factors

Perhaps the most talked-about “tone change” is Nasdaq seeking clearer authority to deny an initial listing even when a company

meets the numerical listing standardsif certain factors suggest the security could be more susceptible to manipulation.

In proposed rule text describing this approach, Nasdaq outlined non-exclusive factors it would consider. These include issues like:

jurisdictional features that limit U.S. investor remedies, blocking statutes or data privacy laws that could impede investigations,

concentrated ownership/float concerns, and the involvement of certain advisors (auditors, underwriters, law firms, brokers, clearing firms,

or other service providers) connected to prior situations involving problematic or unusual trading patterns.

Importantly, Nasdaq also described transparency mechanics: if Nasdaq denies a listing using this discretion, staff would issue a written

determination, and the company would be required to publicly disclose the receipt of that determination (in a Regulation FD-compliant manner),

along with the rules and concerns cited. The company could then seek review by a hearings panel under Nasdaq’s existing process.

Why this matters: It shifts the conversation from “Do you pass the math test?” to “Do you pass the math test and

avoid a pattern of risk factors we’ve seen go sideways before?” For legitimate issuers, that means more diligence up front. For shady actors,

it means the exchange is trying to stop the problem before it becomes a headline.

Who Feels the Impact the Most?

Smaller IPO candidates

Raising MVUPHS thresholds and requiring IPO proceeds to supply that float means very small offerings have less room to maneuver.

Issuers may need to price, size, or structure offerings differentlyor accept that Nasdaq might not be the right venue yet.

Companies already skating near continued-listing minimums

If you’re frequently on the noncompliance list, the overall direction is not your friend. Nasdaq is steadily reducing the practical ability

to remain listed through repeated procedural resets, especially when reverse splits become a routine feature rather than a rare event.

China-based issuers (as defined by Nasdaq’s tests)

The proposed $25 million thresholds and related limits (direct listings, transfers) create a clearer “liquidity floor” and could reshape

the pipeline of very small cross-border listings. This is less about geography in the abstract and more about the combination of enforcement

friction, investor protection, and low-float trading concerns.

Gatekeepers: underwriters, auditors, counsel, and other advisors

When rules start explicitly mentioning “advisors,” it’s a signal that due diligence expectations are rising. Issuers may face more questions

about who is involved, their track record, and whether the overall setup invites unhealthy trading conditions.

A Practical Compliance Playbook (No Cape Required)

-

Model MVUPHS early: don’t leave float math for the week before launch. Confirm what counts as “unrestricted” and

what gets excluded. - Design offerings for durable liquidity: a listing pop is not a liquidity plan. Build a holder base and realistic trading depth.

- Treat reverse splits as a last resort: if the business can’t sustain trading above $1, repeated splits can accelerate delisting risk.

- Watch “stacked deficiencies”: curing bid price while triggering another deficiency can create a compliance trap.

-

Assume more scrutiny on “pattern risk”: if your structure, jurisdictional footprint, or advisor lineup resembles scenarios regulators

have flagged before, expect deeper questions.

Conclusion

Nasdaq’s proposed changes to listing standards reflect a bigger theme in modern markets: a ticker symbol is not just a fundraising toolit’s

a promise of baseline market quality. The exchange appears to be prioritizing liquidity, price discovery, and investor protection by raising

initial float requirements, tightening continued-listing “do-overs,” and adding a clearer mechanism to stop potentially manipulation-prone

listings before they hit the tape.

For issuers, the takeaway is simple: plan earlier, document more, and treat liquidity as a core requirementnot a side quest. For investors,

the takeaway is equally simple: exchanges are trying to make “listed” mean something consistently, even when the market gets weird.

Experiences and Field Notes: What It Feels Like When Nasdaq Listing Standards Tighten (Bonus Section)

When listing standards change, the biggest surprise for many teams is that the stress doesn’t land in one departmentit ricochets.

Legal asks finance for fresh cap table data. Finance asks the underwriter what “counts” as public float. The underwriter asks legal whether

a shareholder is really a 10% holder “directly or indirectly.” Someone opens a spreadsheet named FINAL_v7_REALLY_FINAL.xlsx, and a thousand

auditors quietly nod in solidarity.

One common experience is public float math whiplash. MVUPHS sounds like a single number, but in practice it’s a logic puzzle:

Who is an affiliate? Are shares subject to resale restrictions? Are those “registered for resale” shares actually counted in the way you assumed?

Teams often learn (the hard way) that “public” doesn’t mean “someone other than the CEO.” It means truly unrestricted, non-affiliate shares,

and the definitions matter down to the last footnote.

Another real-world theme is timing risk. If a rule becomes operative 30 days after SEC approval, that window can feel like

a sprint through wet cement. Companies already in the listing pipeline may scramble to finish under prior thresholds, while others decide to

delay and restructure. Either way, the experience is the same: your timeline becomes a strategic asset, not just a Gantt chart.

On the continued-listing side, teams describe minimum bid price compliance as emotionally exhausting. The market doesn’t care

that you have a turnaround plan if your stock trades at $0.93 for ten consecutive days. Reverse splits can feel like a quick reset button,

but the newer posture of the rules makes repeated resets look less like “a plan” and more like “a pattern.” Boards and IR teams often learn to

treat reverse splits like emergency exits: necessary sometimes, but not where you want to live.

When proposed rules start mentioning advisors and gatekeepers, companies also report a shift in the vibe:

who you work with becomes part of the story. Underwriters, auditors, and counsel get asked more pointed questions, and issuers

may spend more time documenting diligence decisions. The practical experience is that “clean structure” and “credible process” become

competitive advantagesnot just compliance chores.

Finally, there’s the investor-communication experience: explaining to shareholders why a company is raising more money, changing its listing plan,

or facing accelerated delisting risk is never fun. The teams that handle it best tend to be blunt but calm: they explain the rule, the timeline,

and the steps being takenwithout pretending the market will behave just because the company asked nicely. In other words: less hype, more clarity,

and fewer promises that sound like they were written by a motivational poster.